Fire Prevention Bylaw Amendment Update: What You Need to Know

Overview

Yorkton City Council has approved updates to the City’s Fire Prevention Bylaw to ensure fairness and transparency in how extra fire-response costs are recovered. Routine residential fire calls continue to be fully funded by property taxes.

Who

Yorkton City Council approved an amendment to the Fire Prevention Bylaw (#26/2025). This amendment introduces cost-recovery caps when Extra Expenses occur—meaning only when additional resources beyond the on-duty crew are required.

What

The amendment establishes cost-recovery caps for Extra Expenses associated with larger or higher-risk incidents.

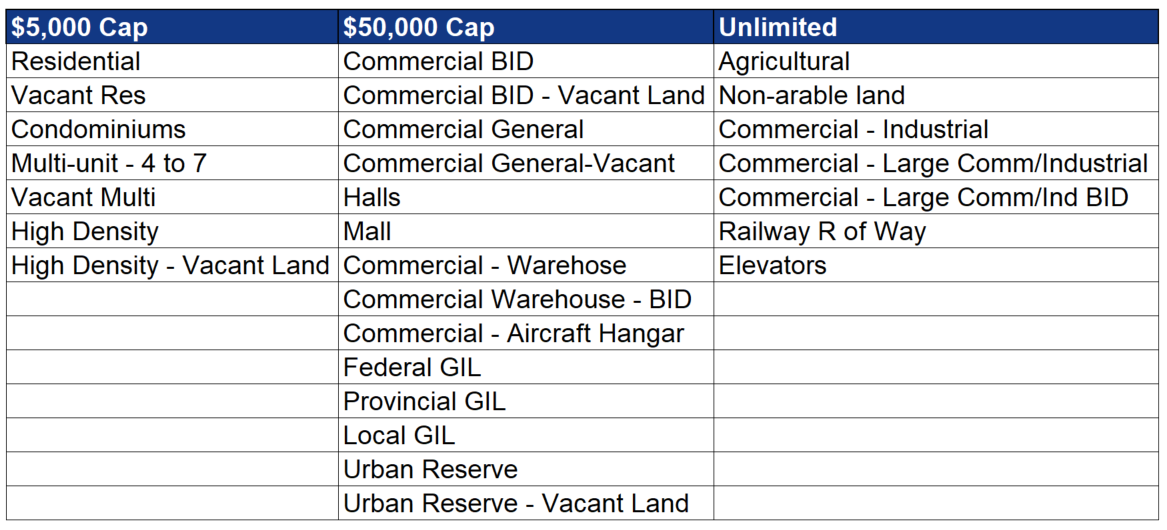

Caps include:

- Residential: Up to $5,000 per incident

- Commercial: Up to $50,000 per incident

- Industrial/Agricultural: No cap, reflecting wider-scale risk potential

Extra Expenses may include:

- Additional off-duty firefighters called in

- Mutual aid from nearby municipalities

- Extra consumables used by a second crew

- Equipment damaged or lost during the incident

What is funded by property taxes (not billed):

- On-duty base crew (4 firefighters)

- Fire trucks, equipment, and command units

- Standard materials and consumables used by the base crew

Insurance Reminder:

Many plans already include coverage for fire-response or suppression costs. Residents and businesses are encouraged to review their policies with their insurance provider.

When

Council approved the amendment on November 17, 2025.

Based on Yorkton Fire Protective Services’ 5-year analysis (2020–2024):

- Extra Expenses would have applied to 14% of fire calls

- Average yearly estimated charges (under the new caps) would have been:

- Residential: $2,120

- Commercial: $2,600

- Industrial: $11,000

Where

The bylaw applies to:

- All properties within the City of Yorkton

- Properties outside city limits covered under formal firefighting service agreements

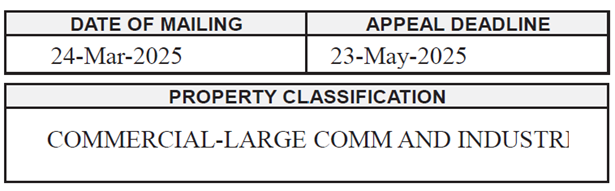

Property classification (residential, commercial, industrial) is determined by municipal tax assessment. The classification that applies to a property determines the cap.

- Sample Property Tax Assessment:

- Property Classification Chart:

Why

The updated bylaw provides a fair and consistent framework for recovering a portion of the costs of extra expenses for fire-response events.

It prevents the full cost of large-scale or high-risk incidents from being placed entirely on all taxpayers.

This amendment does not apply to ordinary residential fires or routine emergency calls, which remain fully funded by property taxes.

Key Points to Remember

- This is not a tax.

- It applies only when Extra Expenses occur.

- It is not retroactive.

- Property classification determines which cap applies.

- Many insurance plans already include coverage for these types of costs.